The house is mortgaged to the financial institution. The minimum savings period is one 1 year and ring fencing can only be used for one 1 house at a time.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

QUOTE mushigen Apr 27 2022 0951 AM If you transfer RM100k to reduce home loan principle your epf account loses 6 of the 100k amount while your home loan saves on 3 or 4 depends on the interest of the 100k you paid off.

. EPF Withdrawals for Medical Payments and Equipment. Subject to the list of approved critical illnesses by the EPF board you can make withdrawals to cover the cost of treatment and buying approved medical equipment not just. This type of withdrawal involves you withdrawing money from your Account 2 to finance your monthly installments for your housing loan which was taken up either to buy a new house or build a new one.

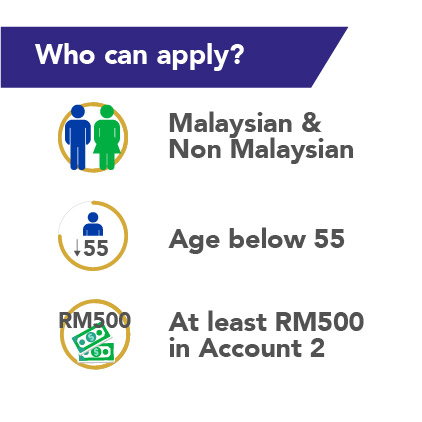

Effective from 2nd January 2001 applicants can also withdraw to reduce or redeeming housing loan for their second house on condition that the first house which was funded from their EPF savings has been sold. You must be an active EPF subscriber for at least 10 years. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house.

Any queries can be sent to the EPF via e-mail. For example if you are buying a property from Kinta Properties Olive Price of Olive. Contributors need to go to the EPF to apply for the monthly withdrawal only once and subsequent payments would be directly credited to their.

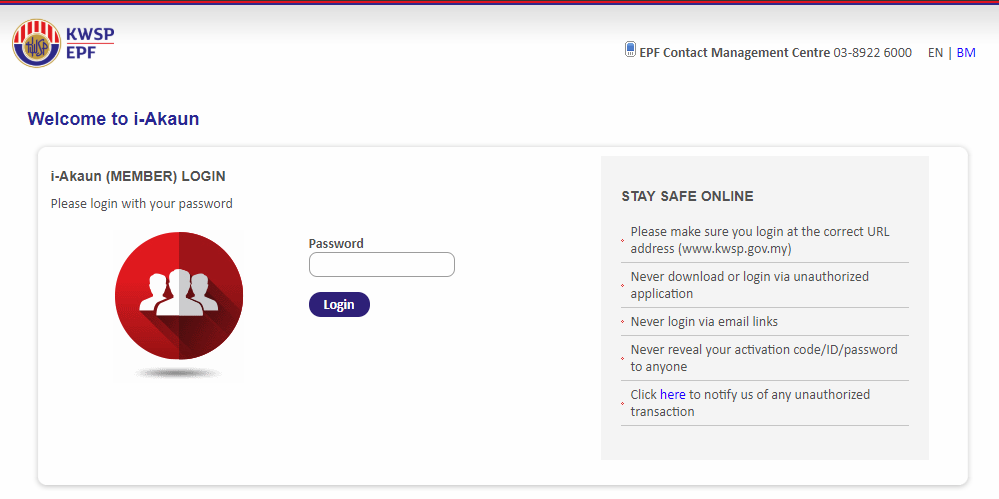

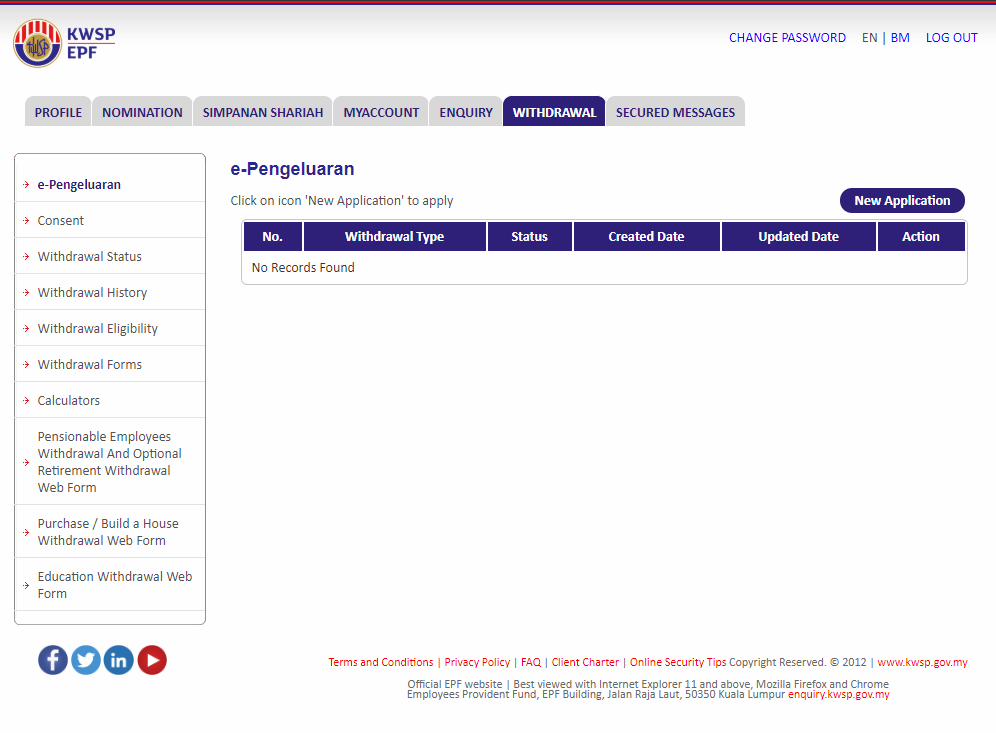

Provide bank account details as per the EPF account. Submit the duly filled form and the withdrawn amount will be credited to your bank account within 15 days. Well there are two criteria under this improvisation-.

WITHDRAWAL FOR SECOND HOUSE Effective from 2nd January 2001 applicants can also withdraw from Account II to purchase or build their second house on condition that the first house which was. Form KWSP 9C AHL. ReduceRedeem Housing Loan.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. You can withdraw the difference between the SPA house price and the housing loan amount which is typically 90 as most first time home buyers have to submit a 10 down payment plus 10 on the price of the house. Building a home is a major investment.

The maximum savings period is up to age 55 or subject to the date of your last housing loan or last day of ring fencing whichever is earlier. Withdrawal from Account 2 to build a house. WITHDRAWAL TO REDUCE OR REDEEMING HOUSING LOAN FOR SECOND HOUSE.

Form KWSP 9Q2 For withdrawals. To assist you with building the home of your dreams we allow our members to withdraw from Account 2 to finance the construction of a new house. The house youre going to improvemodify should be at least 5 years.

Disposal of ownership refers to loss of ownership of the first house owned by you either due to auction surrender of property by court order transfer of ownership because of. You cannot withdraw EPF funds for house renovation it isnt listed in the types of withdrawals. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house.

As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the construction of a new house. For cancellation of withdrawal. Fill the withdrawal form online at the EPF member portal.

Get the Aadhaar authenticated by the employer and link it to UAN. However on the safer side wait for it to turn more than 5 years. EPF Withdrawal to purchase a second house is allowed after the first house purchased utilizing EPF has been sold or disposal of ownership of property has taken place.

Kwsp Epf Partial Withdrawal Buy Home

Epf Members Can Make Withdrawals Up To Rm5 000 Via I Citra Dayakdaily

Governmet Urges Higher Epf Withdrawal For First Time Homebuyers

Sunfert Epf Funding For Fertility Treatment

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Employees Provident Fund Malaysia Wikiwand

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Malaysians Can Now Fund Ivf With Epf Withdrawals Infertility Aide

197 Kwsp Images Stock Photos Vectors Shutterstock

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Kwsp Housing Loan Monthly Installment

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties